“The emancipation of the German is the emancipation of the human being. The head of this emancipation is philosophy, its heart is the proletariat. Philosophy cannot be made a reality without the abolition of the proletariat, the proletariat cannot be abolished without philosophy being made a reality.”

Contribution to the Critique of Hegel’s Philosophy of Law, 1844

Clearly, the fate of Germany and German people were fundamental to Marx’s conception of world crisis and subsequent revolution. Consequently, no-one can deny the centrality of conflict between Continental Germany and Anglo Saxon nations in shaping the global history that followed Marx.

Marx proclaims ‘The German’ as lynchpin of his (war on) philosophy, and his politics. If the emancipation of The German is the emancipation of humanity it must follow that the emancipation of humanity is not possible without the emancipation of The German. And if the emancipation of humanity is not possible without the emancipation of The German, it must follow that the emancipation of The German is a precondition for the emancipation of humanity. If The German is not emancipated, then humanity cannot be.

But in light of the subsequent collapse of German civilisation and the Holocaust we have no choice but to conclude that the liberation of humanity within the terms described by Marx has become an impossibility. How can German ‘workers’ ever lead the world to liberation now? How can they ever be trusted? They are forever discredited; they have built an historical prison from which they can never escape. If the Marxist liberation of humanity were ever to be resurrected, then The German will first have to be liberated from the Holocaust. How can that happen?

Marx’s anti-philosophy is a Turin shroud – a two dimensional image we can lay over the shape of history to see where design fits the real form and where it does not. Two world wars have blown much of The German corpus to smithereens- the remains only barely touch Marx’s design for the future here and there. The lines of Marxism sag downward and warp- just shadows on a sheet, supported by nothing. The whole world can see that the image above does not match that of the body beneath it.

The prospect of Marxist revolution in Germany and the Anglo Saxon territories was delivered the final coup de gras by WWII. In Germany Marxists were literally expunged from the political system. (All that is solid melts into air…) If you were alive in Germany after the conclusion of the Second World War it was de facto proof that you were not a Marxist, nor had you ever been. Correspondingly, in the Anglo sphere the battle to preserve and rehabilitate German culture and morality was understood as existential necessity. All Saxons- left and right understood that whatever sentence Germany served, they also would jointly serve it even if they were dressed as Germany’s jailers. Marxism’s political witness could testify just how far The German had fallen short of the potential of the 19thC. Anglo Saxons had no wish to hear it and no wish to let anyone else hear it either.

It was as if the world deliberately set out to prove all the fallacies of Marxism and humiliate Marx with the demonstration. Marx argued that the material basis of a society is the foundation of all the structures of that society. The more materially advanced a society is, the more advanced it is in every way – this is the material basis for the possibility of communism. But the world wars culminating in the Holocaust proved conclusively that this is not the case.

No matter if civilisation and material advancement were supposed to be betrothed from birth, The German instead made a black marriage between technology and barbarism. The nature of that barbarism is moral, it is fascism. It is simply not credible to be asked to believe that a German ‘worker’ can rape,murder and rob Jews and others because he does not understand his ‘historical role in the class conflict’. After the Holocaust the German worker could never again be portrayed as the hero of history.

“It is not a question of what this or that proletarian, or even the whole proletariat, at the moment regards as its aim. It is a question of what the proletariat is, and what, in accordance with this being, it will historically be compelled to do.”

The Holy Family, 1844

If Marx wanted to divorce the worker from any conception of morality here was his success in spades! Now the German worker was forever more the very epitome of immorality. The millenarian claim that in the end workers would overthrow capitalism and right the world is shown to be no more real than the neo liberal claim that markets self regulate for the benefit of everyone. These are competing statements of faith in the future made in the midst of day to day disaster. Marx refused to accept the centrality of morality and morality was the wheel on which Marxism was broken.

But just as Marxist revolution and Marxist anti-philosophy became impossible in Germany and western Europe, so Marxist economics became an absolute necessity. The collapse of Marx’s war on philosophy made possible the emancipation of Marxist economics. Marxism as revolutionary religious ideology was decapitated. The denuded stump of Marxism, no longer the preserve of political radicals, would serve radical elites instead.

And so we finally come to the old man, his final day on earth passing in an armchair by the fire. Marx is Scrooge the old miser and if Marx is Scrooge then Engels must be Marley, co-conspirator in the enterprise. Unlike Dicken’s novel, neither is troubled by apprehension or remorse- after all what have they to fear? Engels is wealthy and so Marx and his family are well provided for. Both are adamant there is no God, no justice and no retribution.

Nevertheless, retribution comes. I will briefly visit Marx in his death chair with these three spirits: The First, Second and Third Age of Marx in the hope that something of Marxism itself can be reproached, reproved and perhaps even redeemed.

The First Age Of Marx

“The emancipation of the German is the emancipation of the human being. The head of this emancipation is philosophy, its heart is the proletariat. Philosophy cannot be made a reality without the abolition of the proletariat, the proletariat cannot be abolished without philosophy being made a reality.”

Contribution to the Critique of Hegel’s Philosophy of Law, 1844

Fresh from early adventures in poetry and fiction, young Marx embarks upon his critique of Hegel’s philosophy. He expressly endorses Protestantism and Luther in whom Marx sees a herald that proclaims the advent of- himself! And Germany is the centre of the real intellectual universe; the proof and testing ground for Marxism.

‘My dialectic method is not only different from the Hegelian, but is its direct opposite. …. With him it is standing on its head. It must be turned right side up again, if you would discover the rational kernel within the mystical shell.’

Afterword to the Second German Edition of Capital (1873)

Marx is convinced that he has found in his method- the principle of turning Hegel around, the irrefutable answer to everything that had gone before. The anti-thesis to every thesis. All he has to do is apply his method with militant rigour for answers to appear, as straightforward as a chemical titration. Like young Scrooge, hard eyed Marx is determined to build his empire free from the hypocrisy and confusion of those that surround him. In particular, free from his father’s hypocrisy and cowardice. The capstone of this empire and Marx’s ascension to high priesthood will be the conscious forsaking of morality itself. And Marx manages to convince himself that morality will in turn graciously release him from any mutual obligation that might remain.

The Second Age Of Marx

‘Where is the party in opposition that has not been decried as communistic by its opponents in power? Where is the opposition that has not hurled back the branding reproach of communism, against the more advanced opposition parties, as well as against its reactionary adversaries?

Manifesto of the Communist Party

We find Marx in 1848 fresh after the publication of the Communist Manifesto. At face value here is Marx in full pomp; Marxism and communism are storming Europe he claims, and national bourgeoisies are powerless and terrified. Here Communism is acceding to the universality it claims right before our eyes. But look closer and there is something very wrong here:

…It is high time that Communists should openly, in the face of the whole world, publish their views, their aims, their tendencies, and meet this nursery tale of the Spectre of Communism with a manifesto of the party itself. ‘

Manifesto of the Communist Party

Apparently what is abroad in the world is not actually communism but a ‘spectre’ of it. Somehow Marx has lost control of his creation, so he is forced to set out in the manifesto the principle of communism. But this creation is the product of reaction not of principle. In fact, the world has produced a thesis and the Communist Manifesto must be produced to refute that thesis. It must therefore be antithesis. Marx has codified within his manifesto his original error. The manifesto appears in the form of a work of principle- a concise statement. But it is not what it appears to be. It is in reality a reaction- antithesis and is as limited as a reaction-antithesis.

For decades the Communist Manifesto masquerades as a work of principle until the appearance of Das Kapital. Because Communist Manifesto and Kapital are two halves of the same delivery, the world has to wait until the appearance of his deformed afterbirth reveals the extent of Marx’s misconception. Kapital is as it is, because Manifesto fails to be what it claims to be. The afterbirth, Kapital, is as massive as the birth, Manifesto, is undersized. The afterbirth Kapital, is as red and bleeding as the birth, Manifesto, was pale and anaemic. If the manifesto were truly a work of original defining principle there would never have been the need for Kapital as it was. There would never have been a need for Kapital at all. Now towards the end of his second age, Marx washes up for a short while in Paris – spiritual home of every émigré revolutionary and officer of a failed army. Soon he will relocate permanently to England, and his descent will be complete.

In the year 1842-43,…I first found myself in the embarrassing position of having to discuss what is known as material interests…When the publishers of the Rheinische Zeitung conceived the illusion that by a more compliant policy on the part of the paper it might be possible to secure the abrogation of the death sentence passed upon it, I eagerly grasped the opportunity to withdraw from the public stage to my study.

Marx, Preface to the Critique of Political Economy (1859)

The Third Age Of Marx

Marx did not want to deliver his most famous work; ‘Das Kapital’ in the form that he did. It was an agonising decades long spasm of labour forced on him by the circumstances he contrived in his second age. Kapital was a massive undertaking whose fundamental objective was impossible to achieve because ‘Das Kapital’ does not represent the triumphant victory and validation of Marx’s theory. It actually represents Marx’s terms for agreeing to withdraw from the struggle for intellectual supremacy. Das Kapital is a formal resignation letter in which the author offers peace terms to the world. Negotiating defeat and hailing it as victory is hardly novel in history; is it so surprising that Marx did the same? Once Marx lost the battle for philosophical supremacy the world was pleased to let him pick consolation prizes from what remained.

There are three volumes of Kapital but Marx is the actual author of only one: Capital, Volume I (1867). Volume II, ‘The Process of Circulation of Capital’, and Volume III, ‘The Process of Capitalist Production as a Whole’, were constructed by Friedrich Engels and others from notes. This inevitably coloured emphasis, context, and overall meaning of these subsequent two works and thus the entirety. In this amalgam of interpretation and construction is the real birth of ‘Marxism’ as separate and opposed to Marx’s specific thought.

‘Das Kapital’ took prodigious amounts of effort and time. Marx’s correspondence to Engels and others show varying enthusiasm for the project requiring frequent comfort and encouragement , not to mention financial support:

“the thing is proceeding very slowly because no sooner does one set about finally disposing of subjects to which one has devoted years of study than they start revealing new aspects and demand to be thought out further”.

Bouts of despair on Marx’s part are often explained by reference to the sheer size and complexity of the project. The narrative of Kapital, largely accepted even by Marx’s opponents, is one of overwhelming ambition, more or less accomplished according to your view. But in light of Marx’s own description we must ask: For every page that was finally written, where are the ten or a hundred pages that could have been written but were not? Why was Marx driven to write ever more and doomed never to have written enough?

Last Words Are For Fools

The purpose of analysis is to establish ownership of a principle. When an analysis fails all we are left with is an accumulation of description. Analysis has self defined boundaries but description by its nature is boundless. When analysis uncovers the point of principle it is complete. ‘Kapital’ is only description and not analysis because nowhere in this work does Marx secure ownership of the principle. It must forever be incomplete, no matter how large it is. Nowhere does Marx actually seize the initiative. His analysis of the world never secures the point of principle and completes. Kapital is the consequence of this failing. Had Marx been able to seize the initiative years before, or at any time, he would never have been in the position of having to write Kapital in the first place!

Had Marx had won the war of philosophy he could have dictated terms to the world. Instead he is reduced to sifting through what the world can offer in consolation, effectively making a list of all the intellectual property he can claim. Everything except that which he most wanted. Das Kapital is Marx searching though a mountain of words and numbers for something of value commensurate to that which he has already lost…

Finally, at the end, Marx is credited with:

‘Get Out! Last words are for fools who haven’t said enough!’

Perhaps here in his final moment is comprehension of the argument I have been making.

And,most telling of all:

‘If I were merely to consult my own private inclinations….There could…be no better time for scholarly undertakings…what has happened over the last ten years must have increased any rational being’s contempt for the masses as for individuals to such a degree that ‘odi profanum vulgar et arceo’ [I detest and repudiate the common people. Horace] has almost become an inescapable maxim. However all these are themselves philistine ruminations which will be swept away by the first storm.’2

Marx looking for the chaos of revolution to sweep away his very thought processes themselves…

1 and 2

Marx-Engels Correspondence 1858

Marx To Ferdinand Lassalle In Düsseldorf

Source: MECW Volume 40, p. 268;

First published: abridged in F Lassalle. Nachgelassene Briefe und Schriften, Berlin, 1922.

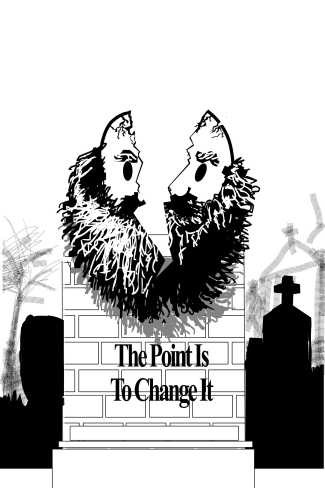

Marxist Theory Is The Hallmark Of Capitalist Development

Marxist Theory Is The Hallmark Of Capitalist Development